How Property Taxes are Prorated for Residential Sales in Greater Cincinnati

How Property Taxes are Prorated for Residential Sales in Greater Cincinnati

Lots of buyers, sellers, some Realtors and even attorneys are confused how property taxes are prorated when a home or condo sale is “closed”.

Lots of buyers, sellers, some Realtors and even attorneys are confused how property taxes are prorated when a home or condo sale is “closed”.

Residential Title Agency was kind enough to provide understandable information about property taxes in Butler, Clermont, Hamilton and Warren Counties which are six months in arrears and paid on a semi-annual basis. When you pay your next tax bill early in 2014- the payment covers property taxes owed for January 1st-June 30th of 2013.

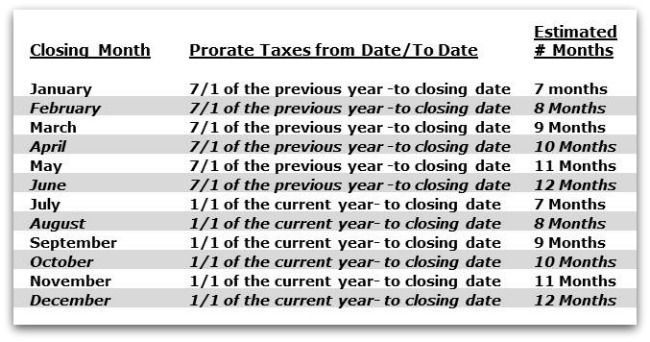

At closing property taxes are “prorated” to the closing date and sellers are responsible for covering the costs. Confusion comes into play when a seller has paid a recent tax bill and sees prorated taxes for 6 or 7 months on the closing paperwork. The chart below may clear up some of the confusion.

Need more information about property taxes or ready to start house hunting now-Click here to to Call: 513-300-4090,by email or Subscribe